|

Round Up

Take the Pressure Off Your Finances

- May 5, 2025 -

Forget florals—this spring, getting a month ahead is in vogue. "Financial responsibility," with its dull, gray heaviness is finally out. For too long, people have been unsure how to actually feel confident about their spending or relaxed about upcoming bills. They restrict themselves from spending and feel guilty when they buy something they like.

Getting a month ahead on your spending will do wonders for your well-being. You’ll feel more grounded, more flexible, more you. We care so much about everyone getting a month ahead that we recently shipped updates to the app so you can get there easier than ever.

Plus, in this issue, why Jesse regrets paying off his mortgage.

|

Quiz question:

A few months’ exposure to financial literacy in high school results in an average lifetime benefit of how much?

- $50,000

- $75,000

- $100,000

- $125,000

(Answer at bottom)

|

|

|

|

Fan Fest

YNAB Fan Fest is coming to Minneapolis on June 13, and it's basically the World Cup of spendfulness. Expect live Q&As, TED-style talks, exclusive merch (!!!), epic raffles, and surprises that will make you do a reconciliation dance. 🎉 Buy your ticket now and save $66!

|

|

|

|

Read

Getting a month ahead is a fundamental piece of the YNAB Method. It shifts your money relationship from reactive—waiting for payday, worrying about timing—to intentional. Learn how our latest feature will help you get there.

|

|

|

|

Watch

Your brain might be holding you back from a more spendful life. A fresh start will bring your spending in line with where you are today, and where you want to go next.

|

|

|

|

Listen

Jesse thought rapid debt paydown would change his life. TLDR: It didn't. He shares what he learned from achieving the dream of no mortgage, and how it actually felt when he made it happen.

|

|

|

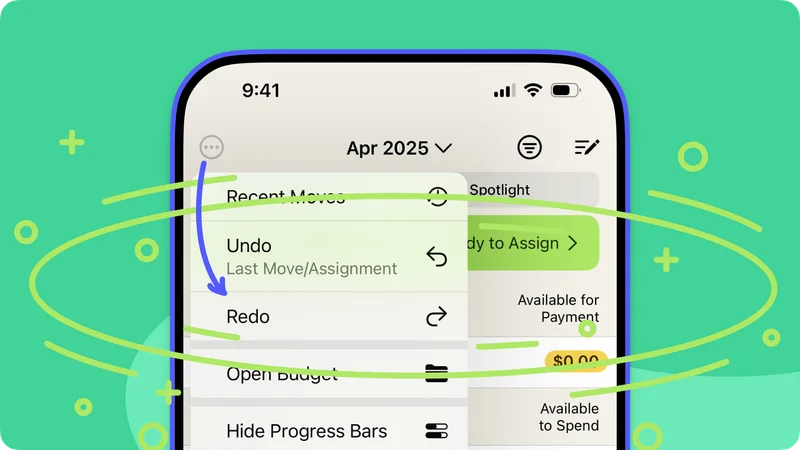

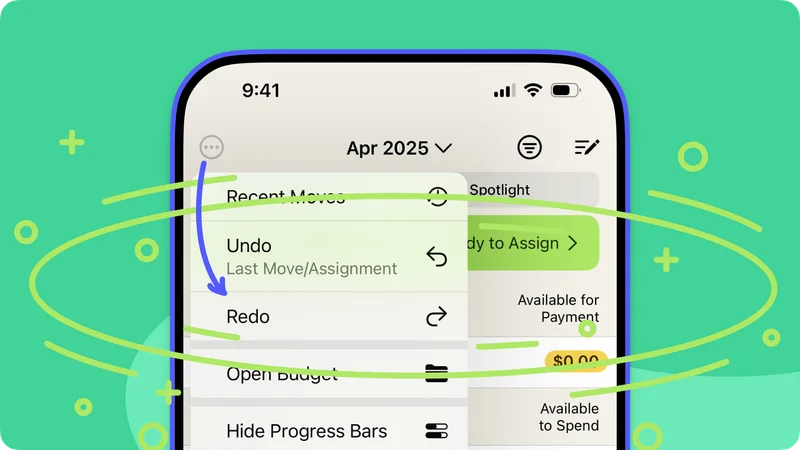

Feature Spotlight

Undo on Mobile is here! Folks at our San Diego Fan Fest got a sneak peek, and now every YNABer on both iOS and Android has the ability to undo recent money moves and assigments.

Did you accidentally use precious funds from your fun money category to cover overspending on groceries? No worries, tap that undo button and your plan is reset. No muss, no fuss. But wait, changed your mind? Easy peasy, hit the redo button and the money will get moved again—because maybe groceries are the VIP this week. YNABing on the go has never been more flexible!

|

Quiz answer: $100,000.

According to a recent study, high-school students who took one semester of a personal finance course gained an average lifetime benefit of $100,000. If you have a teenager in your orbit, invite them for free to YNAB Together, where they can start their own spending plan and develop the skills to be spendful for the long run.

|

|

Like what you're reading? Share with a friend!

|